Australia's balance of payments

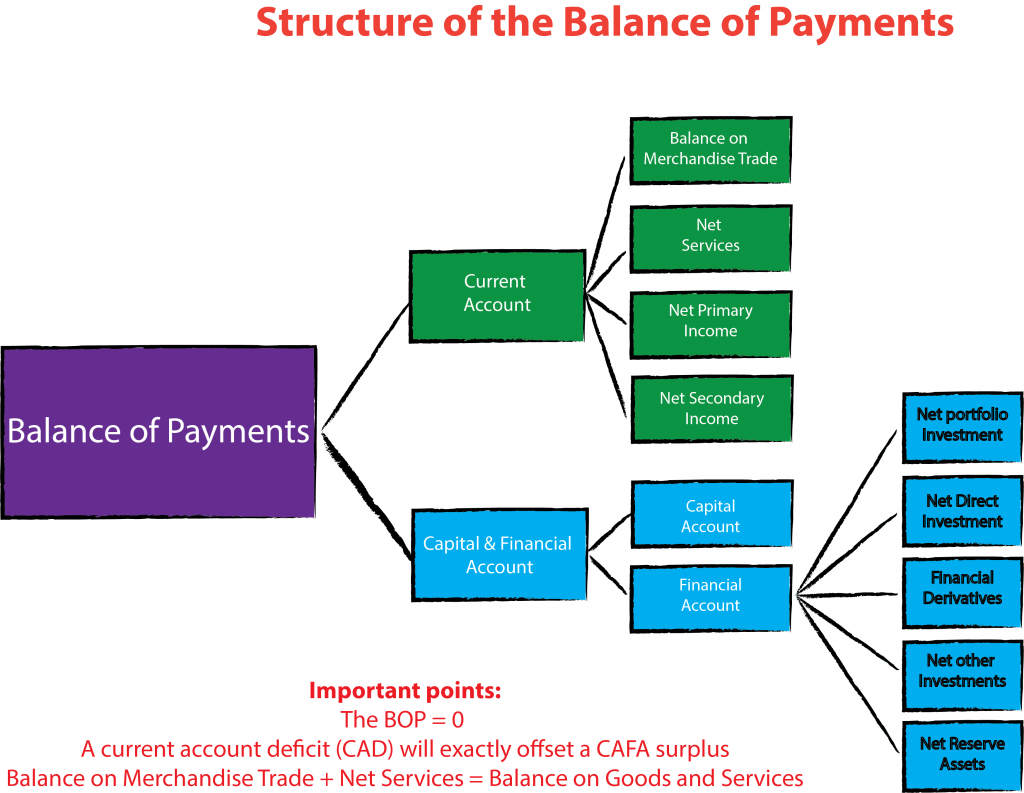

The balance of payments (BOP) provides a record of financial transactions between residents of Australia and residents of the rest of the world. The BOP is compiled primarily from a range of ABS and other agency surveys and all receipts are recorded in BOP as CREDITS and all payments are recorded as DEBITS. The BOP comprises two major accounts, the Current Account (CA) and the Capital and Financial Account (CAFA), and BOP must equal zero over any given period. This means that any CA deficit (CAD) must be exactly offset by a CAFA surplus or any CA surplus must be offset by a CAFA deficit. [While this is true in theory, statistical manipulations are made to ensure that this occurs in practice.]

The CA records all receipts and payments of a ‘current’ (as opposed to ‘capital’) nature. A deficit on the Current Account means that payments to foreigners (debits) exceed receipts from foreigners (credits), where both these are made up of the following:

Payments (debits) are made up of things like:

- payment for imported goods and services;

- interest repayments for foreign debt;

- dividend payments for foreign equity (i.e. profits sent to overseas shareholders);

- other income payments to foreigners (e.g. property income, wages, etc); and

- transfer payments to overseas residents (e.g. gifts, foreign aid, etc).

Receipts (credits) are made up of:

- export receipts;

- interest repayments from foreigners;

- dividend receipts from shareholdings in foreign companies;

- other receipts from overseas (e.g. property income, wages, etc); and

- transfer payments received by Australians.

Overall the Current Account is made up of four separate parts:

- Balance on Merchandise Trade (exports minus imports of merchandise goods, e.g. manufactured goods);

- Net services(exports minus imports of services, e.g. tourism);

- Net primary income(receipts and payments of income such as dividend and interest as well as international labour income); and

- Net secondary income (gratuitous payments/receipts such as foreign aid and gifts).

The Capital Account is a relatively insignificant account and covers capital transfers (such as migrants’ transfers and debt forgiveness) and the acquisition/disposal of non-produced, non-financial assets (such as sales of embassy land or copyrights) between residents and non-residents. The Financial Account is the more important account in that it effectively covers the manner in which Australia finances its CADs.

The Financial Account is made up of:

Official capital inflow (e.g. the Australian government selling bonds to O/S residents, which means O/S residents are lending the Australian govt money);

Official capital outflow (e.g. the Australian government lending money O/S, e.g. buying foreign govt bonds);

Non-official capital inflow and outflow which is made up of:

- borrowing and lending between Australian and overseas residents;

- net direct investment (e.g. setting up a production facility or plant); and

- net portfolio investment (e.g. a less than 10% investment in shares and net debt flows).

An example of the structure of the balance of payments appears below.

Course notes quick navigation

1 Introductory concepts 2 Market mechanism 3 Elasticities 4 Market structures 5 Market failures 6 Macro economic activity/eco growth 7 Inflation 8 Employment & unemployment 9 External Stability 10 Income distribution 11.Factors affecting economy 12 Fiscal/Budgetary policy 13 Monetary Policy 14 Aggregate Supply Policies 15 The Policy Mix