Market Structures

In earlier sections, we learnt about the mechanics of markets. In particular, we learnt how the forces of demand and supply within all markets determine both prices and the allocation of resources. When demand increases in a market, we can predict that it should lead to a higher price, which sends a signal to producers that it might be profitable to devote resources (such as capital and labour) to the production of that good or service. In this respect, an understanding of how markets work enables us to make predictions concerning the impact of various economic events.

The accuracy of our predictions depends upon the structure existing in a particular market, such as the number of competitors. In other words, markets will have unique characteristics concerning the buyers, sellers and the nature of the product itself that will alter the outcome and therefore the accuracy of our predictions. To illustrate, assume that the demand for a product increases. While we can predict that price will rise, we can never be certain by how much. If the relevant market is characterised by only one seller, then the absence of competitive pressure will allow the seller to increase the price by a large amount without suffering a loss of sales. However, if the market is characterised by lots of sellers, we would expect the price to rise by much less, because any business that raises their price by a large amount will simply lose customers to other businesses in the same market.

Similarly, if the supply of a product in a particular market falls, we also know that price is likely to rise, but the question remains of by how much exactly? Again, knowledge of market structures will help us to predict the likely outcome more accurately. If, for example, the world supply of oil fell (perhaps due to wars in oil producing regions), the fact that the market is dominated by relatively few global suppliers means that the increase in oil prices will be significant. On the other hand, if the market for oil were highly competitive, the impact on price would be minimal.

The main characteristics that help us to determine the type of market structure that exists can be summarised as follows:

- The number of buyers and sellers in a market

- The extent to which the product in a market is unique or differentiated from other products

- The freedom with which businesses can enter the market

- The freedom with which businesses can leave or exit the market

- The degree to which buyers and sellers possess information about the products for sale

There are four different market structures that we will examine in this course:

- perfect competition;

- monopolistic

- competition;

- oligopoly; and

- monopoly.

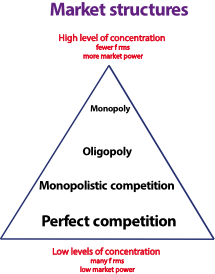

They are listed here in order of the degree of market power (ability to control market outcomes in terms of prices and/or volumes) exercised by businesses operating within each market, with businesses operating in perfectly competitive markets experiencing the lowest degree of market power and the business operating in a monopoly experiencing the greatest degree of market power.

As market structures move from perfect competition to monopoly, the market is said to become more ‘concentrated’. Perfectly competitive markets have a low degree of concentration (i.e. lots of businesses working to dilute market power) while a monopoly market has the highest degree of concentration (i.e. market power is concentrated in one supplier).

Quick Navigation

- Introductory concepts

- Market mechanism

- Elasticities

- Market structures

- Market Failures

- Macro economic activity/eco growth

- Inflation

- Employment & unemployment

- External Stability

- Income distribution

- Factors affecting economy

- Fiscal/Budgetary policy

- Monetary Policy

- Aggregate Supply Policies

- The Policy Mix

- Tutorials/Programs