Income Distribution

The Australian Bureau of Statistics (ABS) defines household income as all current receipts, whether monetary or in kind, that are received by the household or by individual members of the household, and which are available for, or intended to support, current consumption.

In simple terms, income refers to money received by a household or other entity that is primarily to be used for the purchase of goods and services. It not only includes cash (such as the wages received from employment) but other receipts, such as the use of a company car or other non-cash benefits provided by employers. These can be referred to as income in kind.

The following receipts are common examples of income earned by Australian households.

- Wages and salaries received from an employer

- Dividends received from a company

- Profits received from owning an unincorporated business (i.e. a business that is not a company)

- Rent received by a landlord

- A pension received by a retired person

- Job search allowance received by an unemployed person

- Superannuation earnings received by retirees

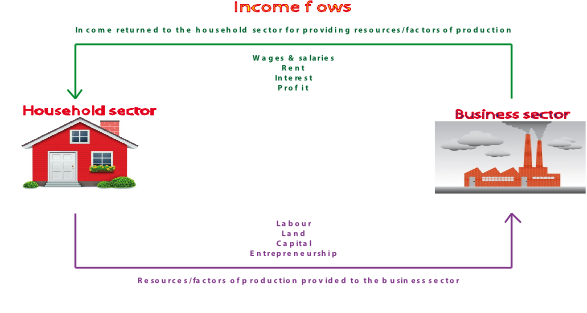

Two major types of income are classified as Factor income and Transfer income. Factor income refers to the total income received by ‘factors of production’ (such as labour) for their contribution to production. Factor income will therefore include wages and salaries because it represents the return to the factor of production – labour – for its productive effort. Factor income will also include dividends and profits because it represents a return for the entrepreneurial risk taken by the owner/investor. Similarly, rent received by the landlord is also a return for providing land and capital (e.g. buildings) in the rental market.

Transfer income is any income that has been transferred from one group to another. The most common form of transfer income occurs via the tax and transfer system in Australia, but it also includes other transfers, such as the money received in child support payments and superannuation receipts. With respect to government transfers, the government collects taxes from economic agents and then transfers this money to other groups via welfare payments, the most common being government pensions and allowances, such as the aged pension and job search allowance. Transfer incomes form an important part of government efforts to reduce inequality.

The diagram below highlights the relationship between households and businesses in terms of flows of factor income.

There are four different market structures that we will examine in this course:

- perfect competition;

- monopolistic

- competition;

- oligopoly; and

- monopoly.

They are listed here in order of the degree of market power (ability to control market outcomes in terms of prices and/or volumes) exercised by businesses operating within each market, with businesses operating in perfectly competitive markets experiencing the lowest degree of market power and the business operating in a monopoly experiencing the greatest degree of market power.

As market structures move from perfect competition to monopoly, the market is said to become more ‘concentrated’. Perfectly competitive markets have a low degree of concentration (i.e. lots of businesses working to dilute market power) while a monopoly market has the highest degree of concentration (i.e. market power is concentrated in one supplier).

Quick Navigation

- Introductory concepts

- Market mechanism

- Elasticities

- Market structures

- Market Failures

- Macro economic activity/eco growth

- Inflation

- Employment & unemployment

- External Stability

- Income distribution

- Factors affecting economy

- Fiscal/Budgetary policy

- Monetary Policy

- Aggregate Supply Policies

- The Policy Mix

- Tutorials/Programs